nj property tax relief 2018

The extended filing date for the 2018 New Jersey Corporation Business Tax Return on October 15 2019 is the same due date as the federal return. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

You are eligible for a property tax deduction or a property tax credit only if.

. Murphy expanded the cap on the tax deduction in 2018 lifting it from 10000 to 15000. Stay up to date on vaccine information. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year.

NJ Property Tax Relief Programs. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. Earlier this year NJ Spotlight News detailed how Murphys first draft of the fiscal year 2022 spending plan called for continuing the practice of inserting technical language into the annual budget to keep property-tax bills from.

Same old end run. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. We will automatically waive the late filing penalty for a corporation business taxpayers with a properly extended federal return due date of October 15.

Eligibility requirements including income limits and benefits available under this program are subject to. However the total of all property tax relief benefits that you receive for 2018 Senior Freeze Homestead Benefit Property Tax Deduction for. Before May 1 2018.

We will begin mailing 2021 applications in early March 2022. 2021 Senior Freeze Applications. Income Tax refunds New Jersey federal and other jurisdictions.

When Did You Send Your Application. The 2021 property tax credits are based on ones 2017 income and property taxes paid. Ad Free prior year federal preparation Prepare your 2018 state tax 1799.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Check Your Eligibility Today. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms.

Data like that explain why Chalker and other advocates knew how important it was to save New Jerseys property tax-relief programs. All property tax relief program information provided here is based on current law and is subject to change. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023.

Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219. Property taxes for 2018 were paid on that home. Property Tax Payer Bill of Rights.

For New Jersey homeowners making up to 250000. 2018 New Jersey gross income. The New Jersey tax credit is a percentage of the taxpayers federal child and dependent care credit.

The property tax bill pays for local government. Forms are sent out by the State in late Februaryearly March. Have a copy of your application available when you call.

How Homestead Benefits Are Paid. That policy change came around the same time President Donald. The amount varies according to the amount of the taxpayers NJ taxable income.

For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. NJ Division of Taxation - Local Property Tax Relief Programs. The latest round of benefits scheduled to be paid in May 2022 are intended to offset the property-tax bills from 2018.

The program was restored in the approved budget that went into effect on October 1 2020. Heres the full breakdown of what you may save under a property tax relief plan Gov. After a burst of calls letters and op-ed columns their efforts paid off last month.

Under New Jersey law if you owe money to New Jersey any of its agencies or the Internal Revenue. State Tax Office 75 Veterans Memorial Drive East Suite 103 Somerville NJ 08876. The Homestead Benefit program provides property tax relief to eligible homeowners.

2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022. Between May 2. The Emergency Rescue Mortgage Assistance.

Enacted in July 2018 increases the maximum Property Tax Deduction from 10000 to 15000. Check Issued on or Before. How Homestead Benefits Are Paid 2018 Homestead Benefit.

Able to locate your 2017 and 2018 property tax bills or proof of the amount of taxes paid. October 31 2018 Reimbursement Checks. Call NJPIES Call Center.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. 2018 Third Round Housing Element and Fair Share Plan. Senior Freeze Property Tax Reimbursement Program.

Water Sewer Rates. Thats not allowed in New Jersey. Save Time Money by Filing Your New Jersey State Tax Return Online Today.

New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and then cut the program by 142 million. 30-Day Penalty Relief for Corporations for 2018. The amount appropriated for property tax relief programs in the State Budget does not include funding for 2018 tenant rebates.

The property-tax write-off is offered to homeowners and also some tenants regardless of their annual income and the biggest tax breaks typically go to those with the biggest property tax bills. New Jersey Property Tax Relief Programs. Your primary residence whether owned.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. The deadline to file 2016 applications was November 2018 said Dean Shah. Phil Murphy announced on Thursday.

Property Tax Relief Programs. If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. All property tax relief program information provided here is based on current law and is subject to change.

The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the. The deadline to file the application is October 31 2022. Most eligible homeowners received their 2016 Homestead Benefit property tax relief around May 1 2019 in the form of a credit on their second-quarter property tax bill.

2018 filing status single. Long-awaited help is coming for homeowners who have fallen behind on their mortgages property taxes and other expenses. State Tax Office Website.

If you owned more than one property in New Jersey only file the application for the property that was your principal residence on October 1 2018. Increasing that income threshold would allow the Murphy administration to. Property Tax Relief Programs.

That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. All property tax relief program information provided here is based on current law and is subject to change.

For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. New program set to launch in NJ. Water and Sewer Rules and Policy Manuals.

The main reasons behind the steep rates are high property values and education costs. COVID-19 is still active. Property Tax Relief Programs Homestead Benefit.

The Top Ten Events In Somerset County Nj This Weekend March 30 April 1 2018 Joe Peters Somerset County Somerset County

Here S How Nj Property Taxes Are Trending Nj Spotlight News

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Nj Property Tax Relief Program Updates Access Wealth

Property Taxes By State Embrace Higher Property Taxes

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Deducting Property Taxes H R Block

Property Tax Reduction Should You Hire An Expert Tax Reduction Property Tax Tax Consulting

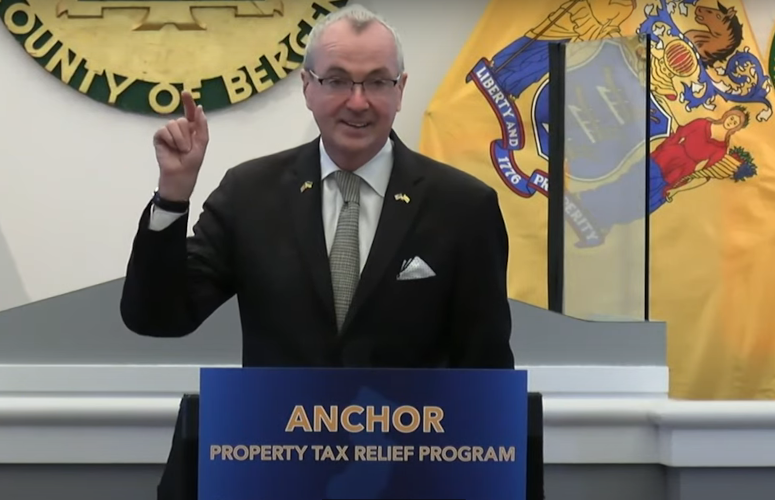

Murphy Proposes 900m Anchor Property Tax Relief Program New Jersey Business Magazine

State Local Property Tax Collections Per Capita Tax Foundation

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Real Property Tax Howard County

Alaska S Property Taxes Ranked Alaska Policy Forum